High-Risk, High Rewards: Strategies to Earn Big! (Caution: Invest at your own Risk)

Today we will talk about unorthodox methods of earning through the blockchain. We will focus on altcoins, whale activity, popularity…

Okay, first of all, buying shit coins as a pump-and-dump strategy is fine. Holding them long- term is what gets you in trouble. Trusting influencers and celebrities that endorse poor crypto tokens solely based on hype is not the smartest move. I am sorry if any one of you has been a victim of shit coin scams. Because there have been quite a few. Just for fun let’s give you a recap before we dive into how you can avoid them.

● Floyd Mayweather and Kim Kardashian: Both Mayweather and Kardashian have promoted cryptocurrencies on social media without disclosing that they were paid to do so. The Securities and Exchange Commission (SEC) later charged Kardashian for failing to disclose a payment she received to promote a cryptocurrency on her Instagram story.

● DJ Khaled: DJ Khaled promoted a cryptocurrency called Centra in 2017. The SEC later alleged that Centra was a fraudulent scheme and that Khaled failed to disclose that he was paid to promote it.

● Steven Seagal: Actor Steven Seagal has also been involved in promoting cryptocurrency projects that have been criticised. In 2017, he promoted a project called Bitcoiin2Gen, which was later accused of being a scam.

● Lana Rhoades: Adult film actress Lana Rhoades launched a crypto NFT project called CryptoSis in 2022, promising high returns but then seemingly abandoned it after raising $1.5 million, leaving investors with worthless NFTs

I hope these were it, but there are many more such examples. Yikes!!!

What Did We Learn From This?

We learned that people need to do their own research. These shit projects only took off because they were promoted by celebrities and investors who did not do their due diligence.

What is a Shit Coin? For Those Who Don’t Yet Know

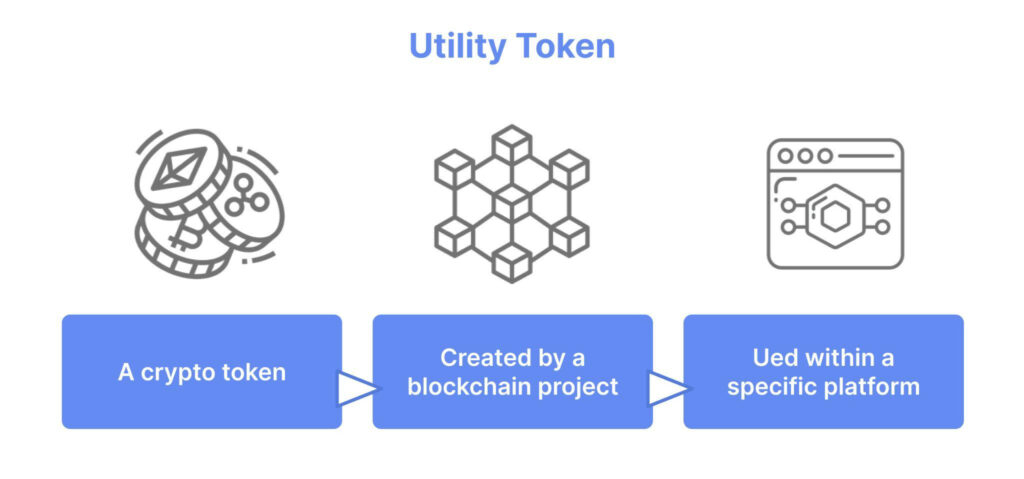

Shitcoins usually pump once or twice and then die. They can bring you profit only when you buy them once at a low price and then sell them during the pump. Such tokens have little to no value, or any particular purpose. Their lack of utility is the biggest giveaway. People only buy such tokens based on hype.

How Do You Avoid Buying Shit Coins?

Avoiding “shit coins” in the cryptocurrency market requires a combination of thorough research, scepticism, and strategic thinking. Here are some key strategies to help you steer clear of low-quality or fraudulent cryptocurrencies:

1. Don’t Believe the Hype, Do Your Research:

Hype can often be manipulated using bot accounts and celebrities. As an investor, you should study the team behind the project. Look at their achievements and history, and try to verify them. Evaluate the project whitepaper and roadmap for more clarity.

2. Don’t Believe the Hype, Do Your Research:

One of the biggest indicators of a shit coin is the lack of any real-world utility. See if the coin is attached to any kind of service or solves any problems. Overly ambitious projects without any clear purpose are just empty promises you should avoid.

3. Check the Community

A strong and active community is usually a good sign that the project is legitimate. But I advise you to look closely at project communities. Excessive promotion and repetitive content are usually a sign of paid advertising. If it seems unnatural it most likely is. Look for genuine discussions and take part in them.

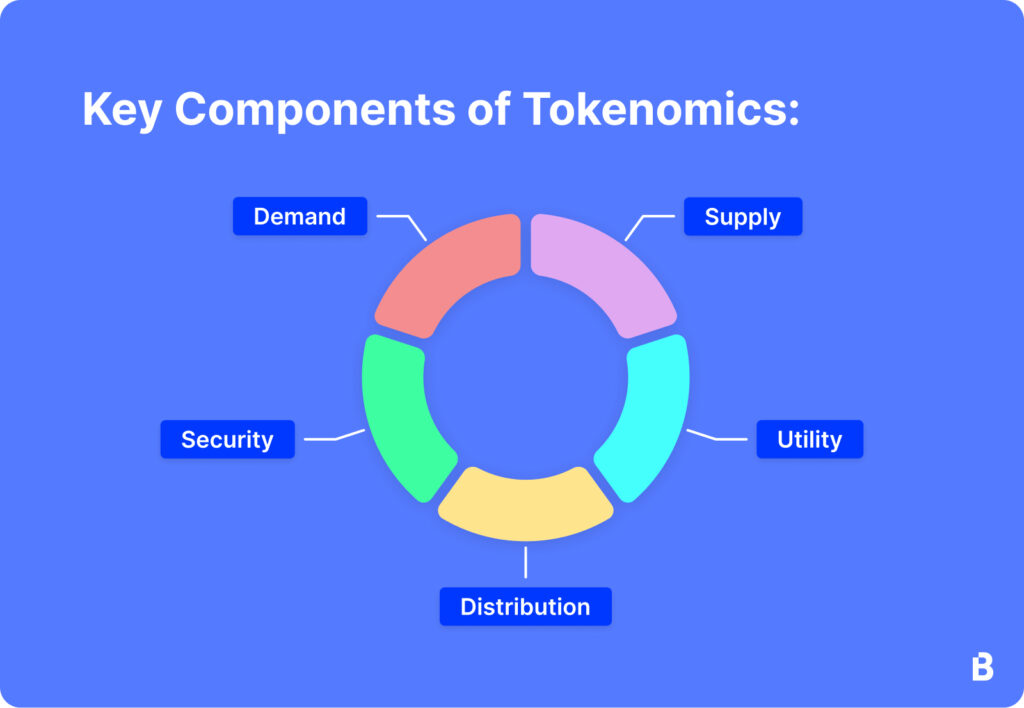

4. Review the Tokenomics

Carefully analyse token distribution, supply, and halving times. Try to avoid projects in which owners or early investors hold a high percentage of tokens, because this usually indicates price manipulation. Moreover, such projects usually end up dead after pump dump manipulations.

5. Examine the Code and Technology

If possible, review the project’s codebase on platforms like GitHub. Look for regular updates, transparent development processes, and peer reviews. Assess the technological innovation and practicality of the project.

6. Use Reputable Sources

Utilise reliable sources for research, such as established cryptocurrency news outlets, analytical platforms, and trusted advisors in the crypto community. Similarly, use reputable exchanges because it is less likely for them to list shady coins.

7. Lack of Liquidity: Big NO!

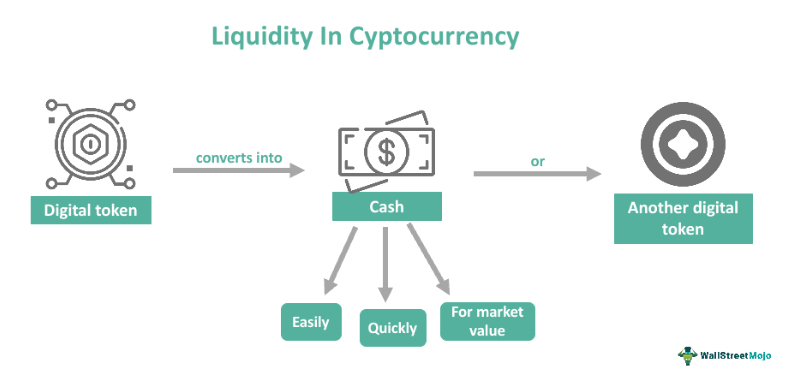

If you are unable to sell the tokens as easily as you can buy them, then they are probably a part of a pump and dump scheme. Moreover, if the token utility factor, whatever it may be, is under development with extended dates then that’s also a bad sign.

Final Thoughts: My Opinion

The road to avoiding “shit coins” is paved with critical thinking and research. Don’t get swept away by celebrity endorsements or FOMO (fear of missing out). By following these steps – researching the team, purpose, community, and tokenomics – you can invest in cryptocurrencies with a higher chance of success. Remember, investing always carries risk, but with a cautious approach, you can navigate the crypto market with more confidence.