How Influencers Sell You Dreams (and Sometimes Nightmares): 7 Steps How You Can Avoid Buying Shit Coins

Okay, first of all, buying shit coins as a pump-and-dump strategy is fine. Holding them long- term is what gets…

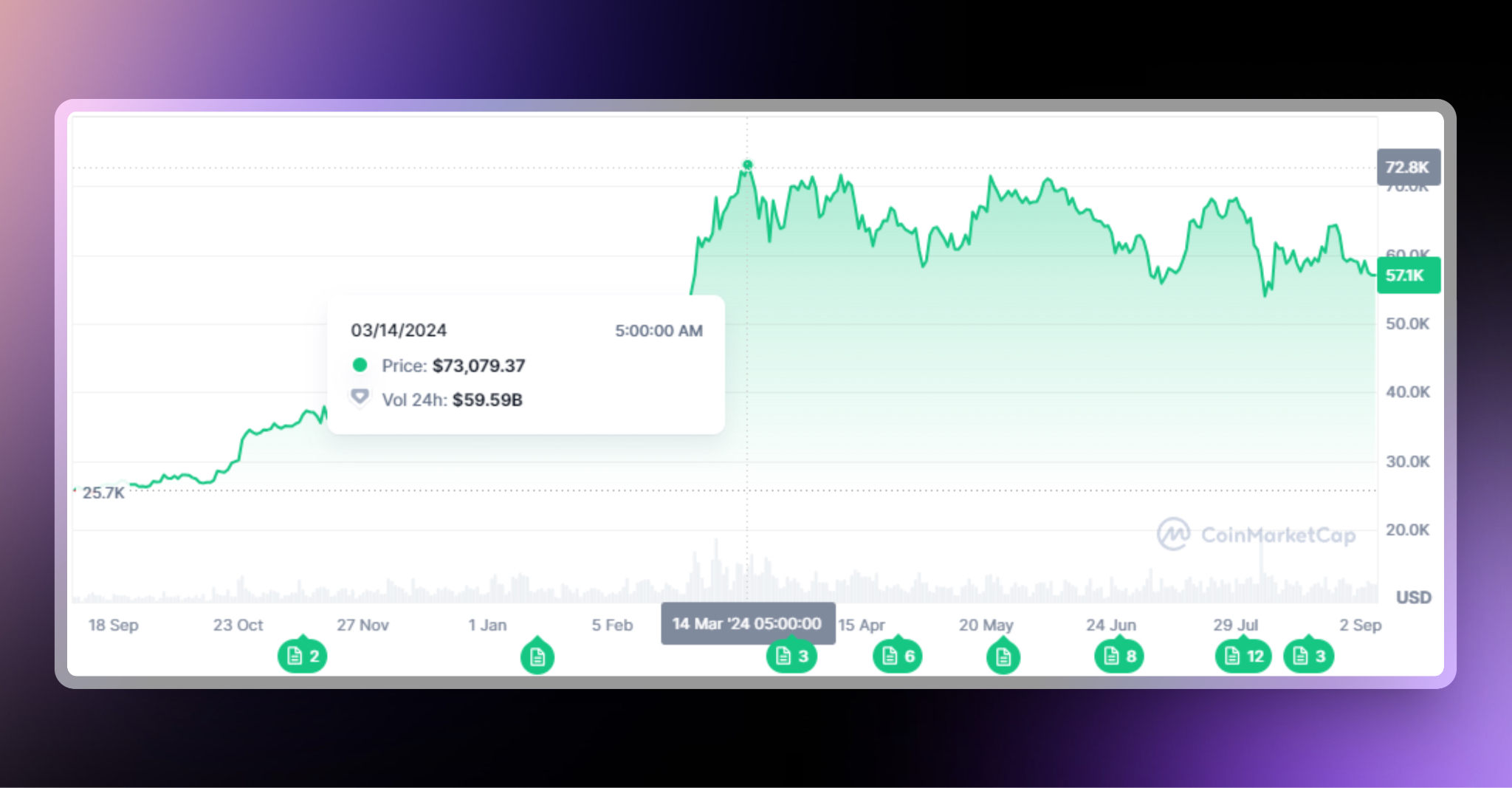

In January, Bitcoin became the first cryptocurrency to be approved by the US Securities and Exchange Commission (SEC) for ETFs. Since then Bitcoin has reached its all-time high price of $75,830 on 14 March 2024.

Ethereum became the second cryptocurrency to have ETF approval on May 23, 2024. So will Ethereum ETFS mimic Bitcoin’s success? Experts have mixed reviews, with many not-so-enthusiastic due to various reasons. (Similar Graph)

Here are 3 Important Factors to Consider Before Investing

Bitcoin’s spot ETF launch in January led to substantial capital inflows, with Citi reporting net inflows exceeding $13 billion by mid-May. This influx drove Bitcoin’s price to an all-time high of $75,830 by March, with a notable 6% value rise per $1 billion inflow. Applying this model to Ethereum, Citi projects inflows between $3.8 billion and $4.5 billion post-ETF launch, potentially boosting ETH’s price by 23-28%. Gemini (Cryptocurrency Exchange) also believes that the new funds will likely attract $3-5 billion in terms of net inflows within the first 6 months of trading.

At Ethereum’s current price of $3,004.22, a 28% increase would set it at $3,841.12 by November. Some people like Andrey Stoychev of Nexo predicts that combined U.S. and Asian ETF launches could propel ETH to $10,000 by the end of 2024, mirroring Bitcoin’s post-ETF performance.

A major difference between Bitcoin and Ethereum lies in their supply dynamics. Bitcoin’s capped supply of 21 million coins is very different from Ethereum’s theoretically infinite supply. Manuel Ferrari of Money On Chain argues this fundamental difference will affect the ETFs’ success. According to Ferrari, Bitcoin’s finite supply contributes to its revolutionary financial and monetary properties, making it a more compelling investment via ETFs compared to Ethereum.

“An Ethereum ETF launch will not be met with the same success as a Bitcoin ETF. Ethereum is not the financial, monetary, and property revolution that Bitcoin is. Two numbers make all of the difference when it comes to the viability of these ETFs as investments. One number is 21 million. The other is infinity. Choose wisely,” Ferrari emphasized.

This makes sense because value is determined based on scarcity, the fiat system already relies on this law.

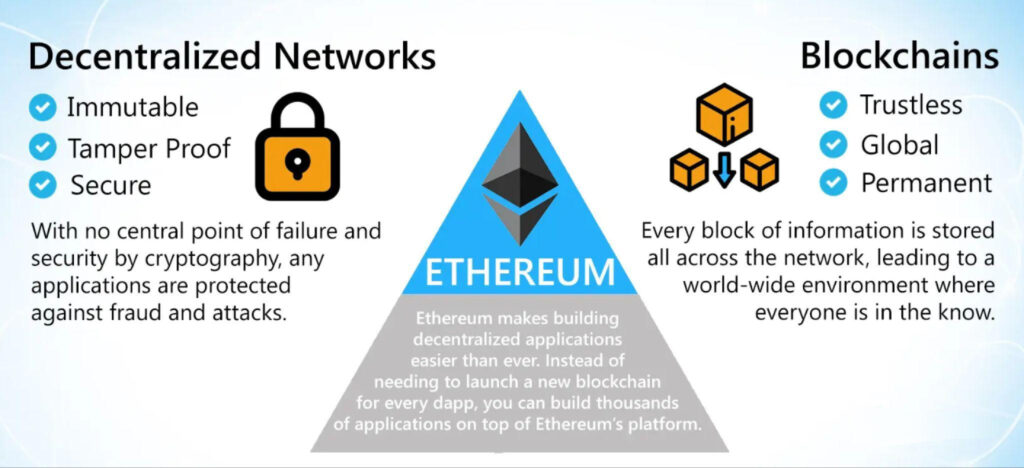

The introduction of Ethereum ETFs could significantly impact the network’s staking activity. Staking has been a cornerstone of Ethereum’s security, with 1.02 million validators currently securing the network. Some experts, like Matthew Sigel of VanEck, warn that ETF launches might entice validators to unstake their ETH in favor of ETFs, potentially compromising network security.

Despite these concerns, not all believe the ETFs will offer better returns than staking. A CCData Research report highlights that a hypothetical 1,000 ETH position held with an ETF provider since January 2023 would have resulted in missing out on over $200,000 in staking rewards.

As of now, 27.68% of Ethereum’s total circulating supply of 120.18 million ETH is staked, reflecting the network’s reliance on staking for security and the substantial rewards validators currently enjoy.

Highlight

While the launch of spot Ethereum ETFs holds promise, several factors could influence their success. The projected capital inflows might drive significant price increases, but differences in supply dynamics between Bitcoin and Ethereum could temper this enthusiasm. Additionally, the potential impact on staking and network security adds another layer of complexity. As the market braces for Ethereum’s ETF debut, these factors will play crucial roles in determining whether Ethereum can mirror Bitcoin’s ETF success.

Final Thoughts: My Opinion

Green Light from Regulators

The SEC has shown a change of attitude towards the blockchain by embracing both Bitcoin and Ethereum ETFs. Both cryptocurrencies have more or less always had investor’s confidence. Given the relaxed approach, I believe that people will continue to stake their Eth and new players will also come into play due to ETF approvals. I can expect the price of Ethereum to be around $4000-$7000 by the end of the year. Use Cases and Burning

Use Cases and Burning

I agree with Manuel Ferrari of Money On Chain that the difference in supply affects the growth of both Cryptocurrencies. Bitcoin with its limited supply has a higher price increase potential per revolutionary changes than Ethereum. However, Ethereum has many use cases as well and this increases its demand. So as long as Ethereum demand (use cases) exceeds its supply creation, we are likely to see its growth. Not to mention that Ethereum also has a burn rate for every transaction to control the inflation rate, a factor Manuel Ferrari did not consider.

The Future of Ethereum Staking

Lastly, when it comes to staking, people will continue to stake their Eth. The rate of Ethereum staking is never constant and can change as needed. Given its history, Ethereum will ensure that staking remains profitable enough, while ETFs also provide rewards. The only concern is unexpected regulations that may damage investor confidence. If this does not occur, favorable global conditions in the UAE, Asia, and hopefully it’s also looking bright in the US.